Background – How a Software Development Agency Transformed Identity Verification

In the early 2010s, identity verification processes across Europe were mostly manual. In Germany, a major postal service provider held a monopoly, while in Poland, couriers or bank employees manually checked identity documents. This process was costly, time-consuming, and prone to errors and misuse. Each verification in Germany cost around €10, while in Poland it took several days to complete.

As a leading AI Software Development Company specializing in automation and artificial intelligence solutions, Stermedia recognized an opportunity to redefine efficiency and security in this critical area.

The Challenge

The issues associated with manual identity verification inspired Stermedia to develop a solution that would automate the entire process. The key challenge was to design a system capable of reliably recognizing identity documents (passports, ID cards, driver’s licenses) while verifying their authenticity and maintaining the highest standards of security. The system needed to not only read the data from the document but also validate its authenticity based on security features.

Stermedia’s Role as a Custom Software Development Firm

Stermedia, a forward-thinking Technology Partner, played a pivotal role as the initiator and technological leader of this project.

Leveraging expertise in machine learning and computer vision, the company developed innovative tools that transformed document verification forever.

Key achievements included:

- Next-generation OCR system: Stermedia created the first OCR solution in Europe capable of reading MRZ (Machine Readable Zone) data with over 98% accuracy.

- Use of Artificial Intelligence: The company applied techniques previously used in medical imaging (e.g., tumor detection in PET scans) to recognize document security features.

- Full process automation: Unlike competitors relying on manual verification, Stermedia introduced a fully automated system eliminating human error.

- Mobile application: Enabled users to scan and verify documents in real time, automatically generating secure PDF reports.

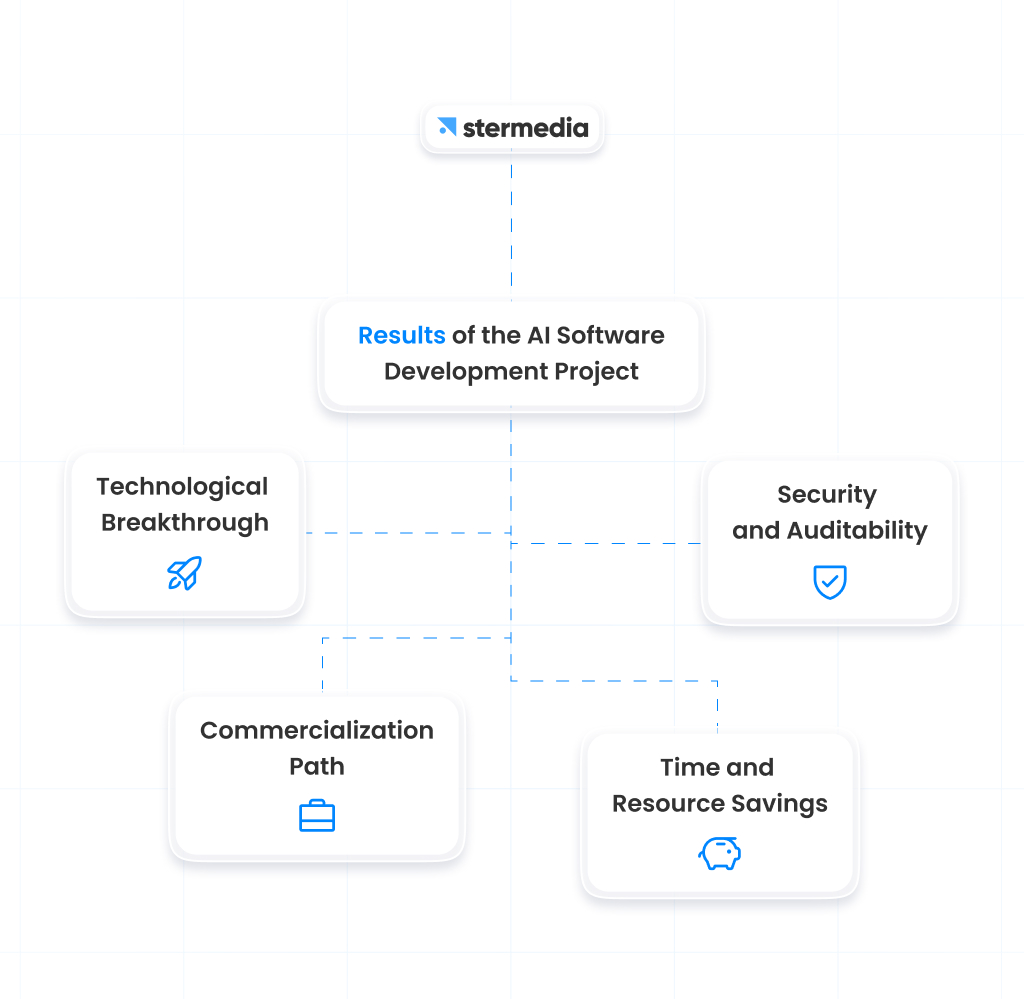

Results of the AI Software Development Project

The OCR system developed by Stermedia marked a technological milestone. It was the first of its kind in Europe and became the foundation for many later solutions adopted by banks and financial institutions for KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

Learn more about KYC and AML standards on the European Commission’s website:

Anti-Money Laundering and Countering Financing of Terrorism — EU Level.

Time and Resource Savings

The system introduced significant efficiency improvements by eliminating the need for manual checks against paper catalogues. The verification process became faster, more effective, and available in real time.

Security and Auditability

The introduction of OCR and mobile verification enabled complete standardization of the identity verification process. Each document was checked for security features, and every step was logged and archived, ensuring full auditability and quality control.

Commercialization Path

Thanks to technological development and process optimization, Stermedia supported the creation of a subsidiary company responsible for further development and commercialization of the solution. Today, this subsidiary remains a leader in the identity verification market.

Further Development and Company Growth

The project initiated by Stermedia did not end with the implementation of OCR technology and automated identity verification. Over time, the solution evolved into an independent technology company that became one of the key players in the identity and biometrics industry.

Stermedia played a significant role in the development of this organization by supporting the establishment of a Polish R&D (Research and Development) branch. Today, this unit operates internationally, achieving major success in identity technology.

An interesting fact is that the company’s white-label solutions (without visible branding) are used by virtually every bank in Poland.

Over time, the Polish branch transformed into a full-fledged technology company with clients in more than 13 countries worldwide. In Poland, its technology is used by the largest banks and state-owned enterprises, while abroad it serves financial and technology institutions in Canada, the United States, Africa, and other regions. Its solutions are present on almost every continent — except Australia.

The company continues to develop AI-driven solutions focused on:

- facial recognition and biometrics,

- fraud detection (deepfake and spoofing prevention),

- automatic identity document verification.

One of the company’s key achievements is a biometric system capable of recognizing users even when their appearance changes — such as aging, facial hair, glasses, or other facial differences. The system supports over 250 types of identity documents from various countries, which is critical for international expansion.

The company holds the ISO/IEC 27001:2013 certification, confirming compliance with the highest standards of information security for cloud-based data processing. It also undergoes regular security audits and penetration testing, which are essential in the identity technology sector.

In recent years, the company has been frequently featured in the media as an example of a Polish technology firm effectively combating deepfakes, significantly increasing its recognition and reputation.

Summary – Software Development Agency Leading the Future of AI Automation

As a world-class Software Development Agency, Stermedia not only delivered an innovative product but also helped shape the future of the identity verification industry.

By combining AI software engineering, automation, and security, the company continues to drive digital transformation for clients around the globe.

Learn more about our AI-driven projects and process automation on Stermedia.ai or explore our other case studies featuring solutions for healthcare, finance, and industry.

Want to automate identity verification in your organization?

Get in touch — together, we’ll design a tailored AI solution for your business.

Contact Stermedia